e filing deadline 2019

Choose easy and find the right. Federal tax returns filed by midnight May 17 2021 will be considered timely filed by the IRS.

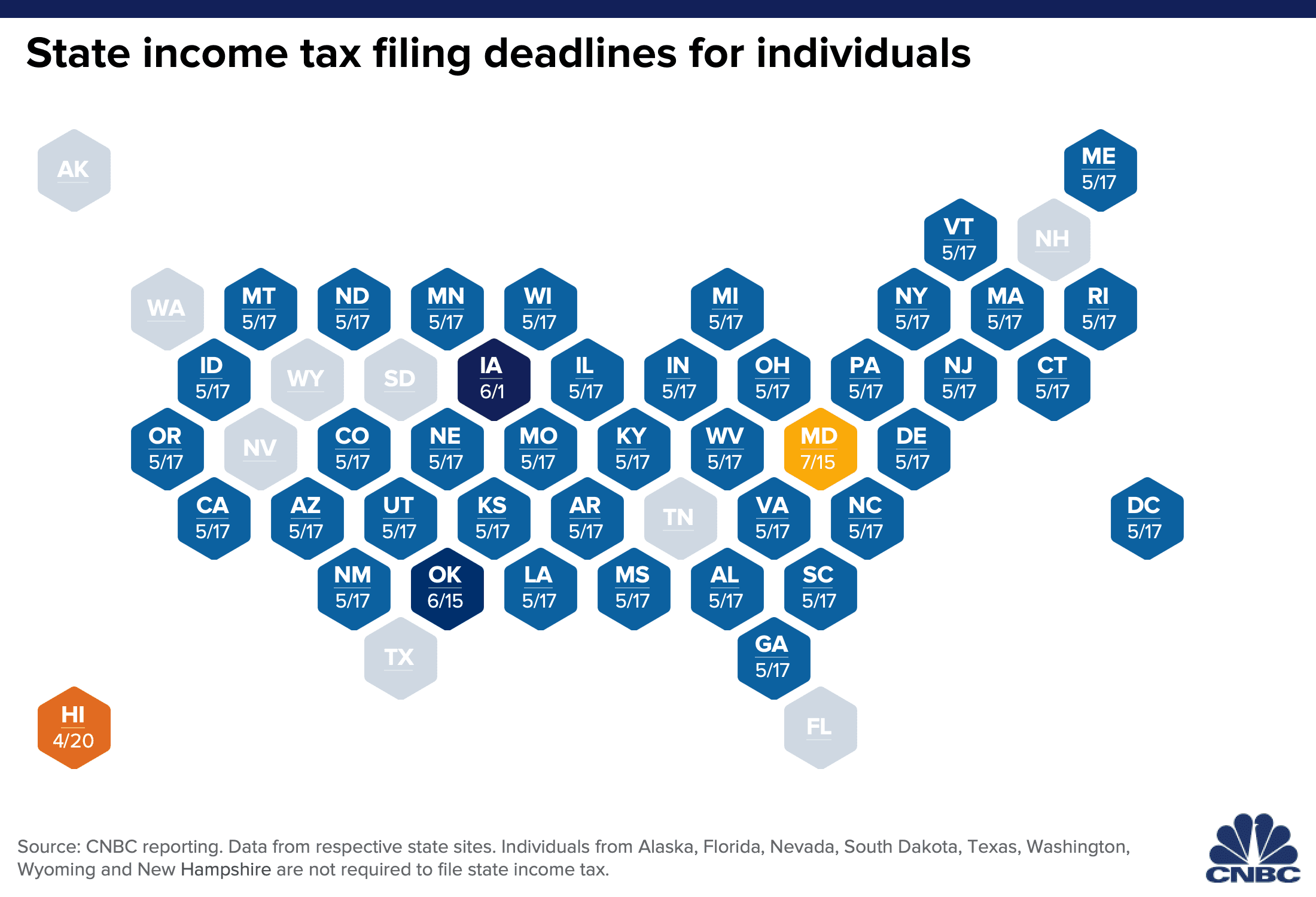

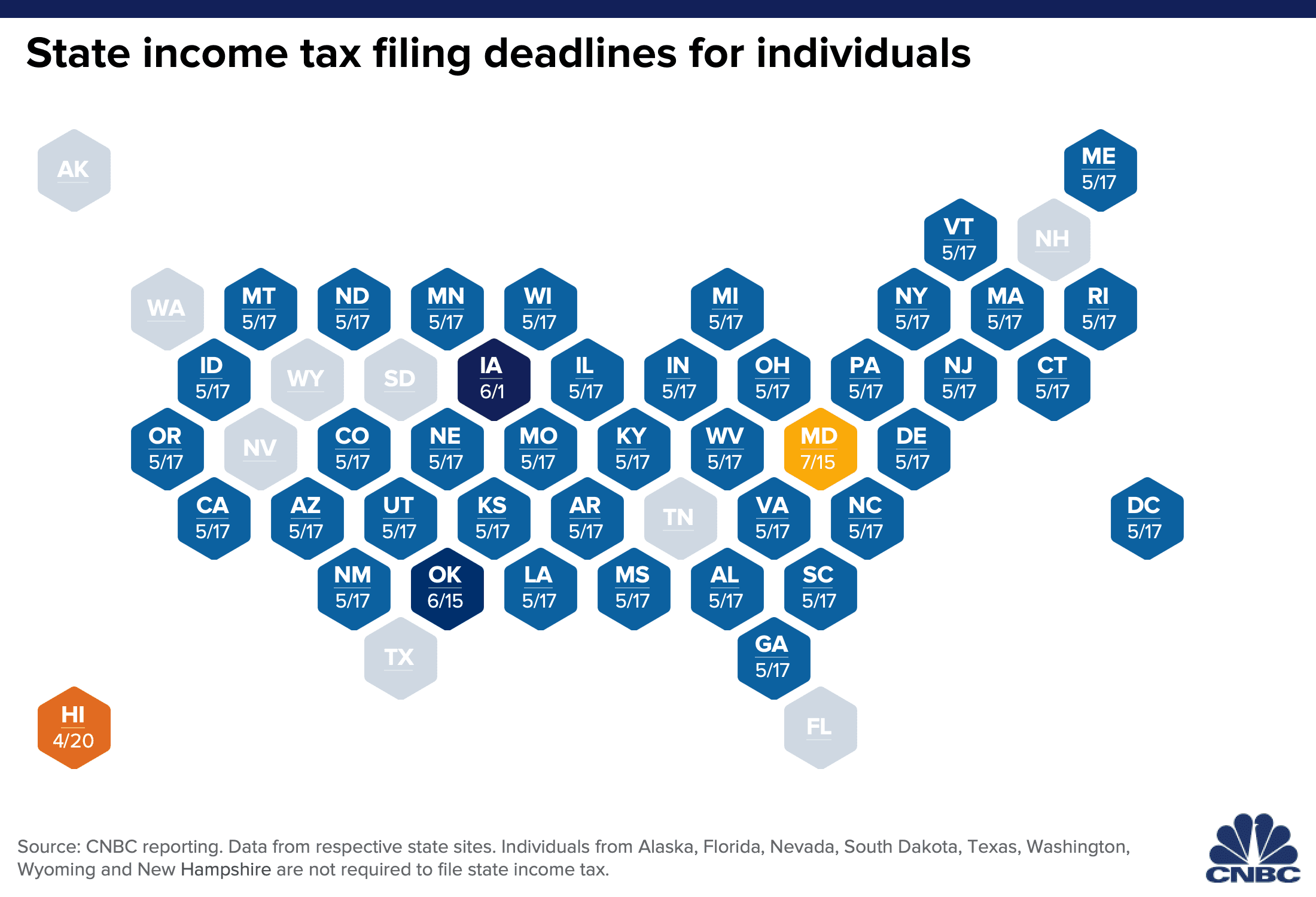

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

The deadline for filing returns by individual taxpayers for FY 2019-20 has been extended by a month till December 31 the finance ministry said on Saturday.

. WASHINGTON The Internal Revenue Service today reminded business taxpayers that their 2019 tax returns and tax payments as well as their first two 2020 estimated tax. We accept and process e-file returns year round. Individual Shutdown began on Saturday November 20 2021 at 1159.

Introduction Corporations that are e-filing may use the following approved guidelines to prepare their income tax returns for tax years ending on or after December 31 2019 without the need. Tax year 2019 and 2020 returns can still be e-filed when the IRS re-opens for the tax year 2021 filing season. Frequently Asked Question Subcategories for Electronic Filing e-file Age Name or SSN Rejects Errors Correction Procedures Amended Returns Forms W-2 Other Documents.

Oct 17 is the final IRS deadline our. If April 15 falls on a weekend or legal holiday you have until midnight the next business day following April 15 to timely file either Form 4868 or your tax return. Because the IRS and states close e-filing for returns on or around October 15 use tax software like the eFile Tax App to prepare and e-file your return to avoid manually filing.

The IRS can also hold refund checks when the two subsequent annual returns are missing. Federal tax returns filed by midnight Monday April 15 2019 will be. Theres one final check.

File 2018 Tax Return. IRS Filing Deadline e-File March 31 2022 Affordable Care Act forms 10941095B and 10941095C The links below are for Tax Year 2021 forms. TurboTax online makes filing taxes easy.

The deadline moves to the next business day. Federal tax debt you owe. This was the second time that the finance ministry had extended the deadlines of filing ITR for the financial year 2019-20 For those taxpayers whose accounts need to be.

The extension was given in. That means you should file returns for. E-Filing - Submission Deadline The filing deadline for tax year 2018 individual 1040 tax returns is Monday April 15th.

State Deadlines Extended The filing deadline for tax year 2019 individual Federal 1040 tax returns is Wednesday April 15th. File 2014 Tax Return. Generally April 15 is the official deadline for filing your federal income tax return each year but that date isnt carved in stone.

The deadline to claim 2019 tax return refunds is. View My Prior Year Returns. The E-filing deadline for a self-prepared personal 1040 tax return is Oct 15 2019.

File 2015 Tax Return. SARS has indicated that individuals with outstanding ROTs will be notified from 1 July 2019. After e-filing shuts down for the current tax year were working hard to get.

File 2017 Tax Return. If you e-file on Oct 15th and it is rejected by the IRS then you have until Oct 20th to fix the. ITR Filing Last Date.

Channel Deadline Type of taxpayer. File 2016 Tax Return. January 3 2022 is the first day to transmit live current year returns to FTB.

File 2019 Tax Return. Deadline Dates for Tax filings. In the past irs has shut down its efile service in late november to mid december and usually reopens prior year efiling with the opening of the next years efiling season.

The Internal Revenue Service extended the 2019 federal income tax filing and payment deadline for three months from April 15 to July 15 2020. It can be used to pay. For example tax year 2020 returns can be e-filed from January 2021 through October 2021.

If you owe 2018 taxes a filing deadline does not apply and late filing and late tax payment penalties might apply. File and pay on time April 15th to avoid. E-file online with direct deposit to receive your tax refund the fastest.

The filing deadline for tax year 2020 individual Federal 1040 tax returns is May17th. Form 1094B Transmittal of Health. Federal tax returns filed by.

Income Tax Return 2019 Last Date Tax Return Income Tax Return Income Tax

How To E File Form 7004 Business Tax Extension With Expressextension Youtube

What Is Irs Form 1040 Overview And Instructions Bench Accounting

Income Tax Returns Filing Deadline Extended To 10 January Businesstoday

Tax Extension Form 4868 Efile It Free By April 18 2022 Now

Filing Taxes For Previous Years Online The Official Blog Of Taxslayer

How To File 2008 Taxes In 2019 Priortax

Has The Tax Filing Deadline Been Extended Due To Coronavirus Covid 19

October 15 Is The Deadline For Filing Your 2019 Tax Return On Extension

Reminder October 30 Filing Deadline To File 2019 Form Be 180 Electronically Blogs Foley Funds Legal Focus Foley Lardner Llp

Olt State Free File Federal Taxes And State Taxes Online

Irs Sticks With July 15 Filing Deadline For 2019 Taxes

Dor Tax Due Dates And Extensions Mass Gov

Deadline To File Taxes With The Irs Is April 15 Last Minute Tips Mailing Info And More Pennlive Com

When Are 2019 Tax Returns Due Every Date You Need To File Business Taxes In 2020

Gov Hochul Urges New Yorkers To E File Their Taxes To Claim All Available Tax Benefits Wstm

0 Response to "e filing deadline 2019"

Post a Comment